E.P.I.C. fund

Offering investors access to a fund with a sustainability focus at its core.

Allowing investors to make Ethical and Prosperous Investment Choices (E.P.I.C), E.P.I.C Global Equity Opportunities Fund utilises our multi-manager expertise. Blending products from a range of top-tier asset managers (externally), we have created a single investment fund, giving investors access to three major themes centred around digital transformation, health & wealth and sustainable planet.

The fund is classified as Article 9 under the European Union Sustainable Finance Disclosure Regulation (SFDR), which represents the highest sustainable investing classification and means that it must have a sustainable investing focus as its objective.

It is committed to having 100% of its assets (excluding cash) invested in securities that we believe are sustainable investments, based on our extensive research.

Why this fund?

Interest in ESG or sustainability focussed funds has continued to grow in Asia with investors looking for investments that reflect their own personal ethics. This fund allows investors to access an investment that has a sustainability focus at its core.

As well as aligning with the demand for sustainability focussed investments, the fund also utilises our core approach to investing through multi-management, being actively managed and fully diversified.

- E.P.I.C. Global Equity Opportunities Fund (the “Fund”) is a sub-fund of Architas Multi-Manager Global Managed Funds Unit Trust (the “Trust”) which is an umbrella open-ended unit trust domiciled in Dublin, Ireland. Its home regulator is the Central Bank of Ireland (the “CBI”).

- This Fund invests primarily in a diversified and actively managed portfolio of global equity securities with a focus on sustainable investments, in particular, by way of investment in other collective investment schemes.

- This Fund is subject to the following key risk factors: risks associated with sustainable investments, risk relating to dynamic asset allocation, risk of investing in other collective investment schemes, index fund risk, emerging markets risk, Eurozone risk, equity risk, small-cap and/or mid-cap company risk, concentration risk and currency risk.

- Investors should not make investment decisions based on this document alone and should read the offering document (comprising the Prospectus, Supplements, Hong Kong Covering Document and Product Key Facts Statement of the Fund) for details including risk factors.

- Before you decide to invest, make sure the intermediary has explained to you that the Fund is suitable for you.

E.P.I.C. Global Equity Opportunities Fund

This Fund aims:

The objective of the Fund is to seek to provide long-term growth of capital with a medium to high volatility level from a diversified and actively managed portfolio of global securities with a focus on Sustainable Investments. Sustainable Investments are investments in companies engaging in economic activities that facilitate the achievement of at least one of the environmental (“E”) objectives[1] as provided for in the EU Taxonomy Regulation and/or social (“S”) objectives[2] as provided for in the EU regulation on sustainability-related disclosures in the financial services sector (“SFDR”), do not significantly harm any of these environmental and/or social objectives, and where the issuer of each investment follows, in the view of the Manager and/or Investment Manager, good governance (“G”) practices (when taken together, “ESG”).

Portfolio

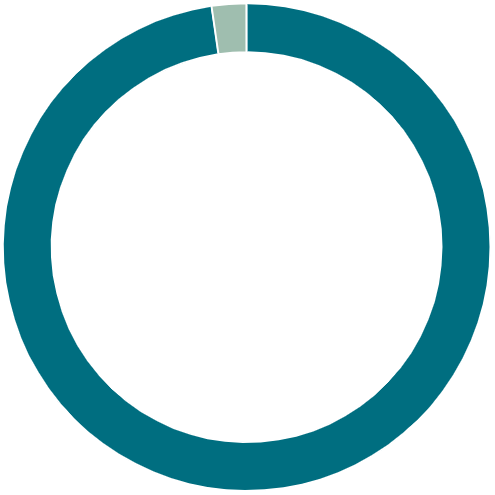

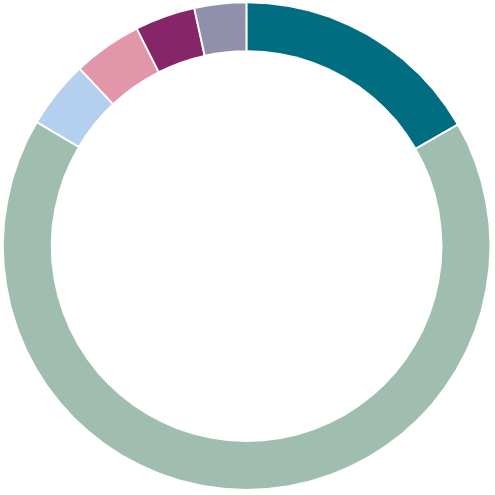

The pie charts below highlight the investment diversification within the E.P.IC. Fund. Please note these charts have been provided for illustrative purposes and they will change over time. For the latest breakdowns, please see the factsheet.

Asset classes

| ● | Equities | 97.70% |

|---|

| ● | Cash | 2.30% |

|---|

Geographic regions

| ● | Europe | 16.69% |

| ● | US | 66.83% |

| ● | Asia | 4.49% |

| ● | Japan | 4.56% |

| ● | UK | 3.99% |

| ● | EM | 3.45% |

Investment managers

| ● | Portfolio Cash | 3.82% |

| ● | BG WW POSTIVE CHNG B USD ACC | 4.55% |

| ● | AB FCP I SUS GLB THEM S1USD | 13.18% |

| ● | AXA WORLD GL FTR SUS EQ ZIU | 19.44% |

| ● | BNP AQUA I EUR | 5.04% |

| ● | AMUN MSCI WLD CL TR CTB IU | 18.24% |

| ● | AXA WF FRAM EVOL TRND GCUSDA | 12.86% |

| ● | NATIX THEMATICS SAFETY IAUSD | 2.27% |

| ● | NN HEALTH+WELL I CAP USD | 4.95% |

| ● | SCHRODER HEALTHCARE INNOV C | 5.33% |

| ● | ROBECOSAM SMART ENERGY E I U | 5.66% |

| ● | ROBECOSAM SMART MOBILITY I U | 4.67% |

Architas E.P.I.C Global Equity Opportunities Fund

Fund documents

Architas E.P.I.C. Global Equity Opportunities Fund - Key fact statement

Prospectus

E.P.I.C. Global Equity Opportunities Fund Retail Class R (USD)

Architas E.P.I.C. Global Equity Opportunities Fund Periodic Report

Architas MM Global Managed Funds Unit Trust Full Financial Statement 2022 (audited)

Architas MM Global Managed Funds Unit Trust Interim Financial Statement Mar 23 (unaudited)

Architas E.P.I.C Global Equity Opportunities Fund

Investment Objective of E.P.I.C. Global Equity Opportunities Fund

The objective of the Fund is to seek to provide long-term growth of capital with a medium to high volatility level from a diversified and actively managed portfolio of global securities with a focus on Sustainable Investments. Sustainable Investments are investments in companies engaging in economic activities that facilitate the achievement of at least one of the environmental (“E”) objectives1 as provided for in the EU Taxonomy Regulation and/or social (“S”) objectives2 as provided for in the EU regulation on sustainability-related disclosures in the financial services sector (“SFDR”), do not significantly harm any of these environmental and/or social objectives, and where the issuer of each investment follows, in the view of the Manager and/or Investment Manager, good governance (“G”) practices (when taken together, “ESG”).

When selecting the CIS to invest in, the Manager and/or Investment Manager will invest only in CIS which are classified as Article 9 in line with the SFDR i.e. underlying CIS which focus on Sustainable Investments in accordance with the SFDR (“Article 9 CIS”).

- VGhlIEVVIFRheG9ub215IFJlZ3VsYXRpb24gZXN0YWJsaXNoZXMgc2l4IGVudmlyb25tZW50YWwgb2JqZWN0aXZlczogKGkpIGNsaW1hdGUgY2hhbmdlIG1pdGlnYXRpb247IChpaSkgY2xpbWF0ZSBjaGFuZ2UgYWRhcHRhdGlvbjsgKGlpaSkgdGhlIHN1c3RhaW5hYmxlIHVzZSBhbmQgcHJvdGVjdGlvbiBvZiB3YXRlciBhbmQgbWFyaW5lIHJlc291cmNlczsgKGl2KSB0aGUgdHJhbnNpdGlvbiB0byBhIGNpcmN1bGFyIGVjb25vbXk7ICh2KSBwb2xsdXRpb24gcHJldmVudGlvbiBhbmQgY29udHJvbDsgYW5kICh2aSkgdGhlIHByb3RlY3Rpb24gYW5kIHJlc3RvcmF0aW9uIG9mIGJpb2RpdmVyc2l0eSBhbmQgZWNvc3lzdGVtcy4=

- VW5kZXIgU0ZEUiwgdGhlIHNvY2lhbCBvYmplY3RpdmVzIHJlZmVycyB0byB0YWNrbGluZyBpbmVxdWFsaXR5IG9yIGZvc3RlcmluZyBzb2NpYWwgY29oZXNpb24sIHNvY2lhbCBpbnRlZ3JhdGlvbiBhbmQgbGFib3VyIHJlbGF0aW9ucywgYXMgd2VsbCBhcywgaW52ZXN0bWVudCBpbiBodW1hbiBjYXBpdGFsIG9yIGVjb25vbWljYWxseSBvciBzb2NpYWxseSBkaXNhZHZhbnRhZ2VkIGNvbW11bml0aWVzLg==

ESG due diligence

The independent ESG due diligence is mainly designed to assess an Article 9 CIS’s ESG integration capabilities. The due diligence relies on detailed proprietary ESG questionnaire, followed by face-to-face due diligence meeting(s) with the Article 9 CIS’s manager and cover:

- ESG policy and governance (e.g. review of ESG assessment report by independent external ESG bodies (where available), monitoring of whether the Article 9 CIS’s manager is adhered to the ESG policy in making the investment management decisions, accountability of the Article 9 CIS’s manager, alignment of the remuneration of the Article 9 CIS’s manager to the attainment of ESG objectives, etc.)

- Integration of ESG consideration in investment decision process of the Article 9 CIS (e.g. assessing reliability of the ESG data sources, analysis on how ESG consideration would impact securities selection process, assessment of the ESG exclusion criteria, etc.)

- Engagement and voting (e.g. whether the Article 9 CIS’s manager would attend shareholder meetings and exercise voting rights to influence the activities of the issuers of the Article 9 CIS’s underlying investments, and engage with the issuers of the Article 9 CIS’s underlying investments to promote good governance)

- Monitoring and reporting of the attainment of the Article 9 CIS’s ESG focus and investment objectives (e.g. assessing robustness of the ESG risk monitoring process, how the ESG’s performance is measured, accessibility of ESG performance reports, etc.)

The ESG questionnaire also includes a question in the Risk & Reporting section, focused on Climate Risk, to factor that into our analysis, to funds in scope, funds must score 0.5 or 1 in that question to be eligible for investment and funds that score 0 will be ineligible.

Using the information collected from the ESG due diligence as described above, the Manager and/or Investment Manager will form a view on the robustness of the ESG process of the Article 9 CIS (including peer comparison) and compute its aggregated ESG score with AXA IM Select in-house scoring process on the ESG dimensions. The ESG scoring is ranging from 5 (the best) to 0 (the worst). With positive screening, an Article 9 CIS with a higher ESG score would relatively have a higher chance to be selected for investment. Any Article 9 CIS which is scored below 3 will be removed from approved buy lists, and thus, such CIS will not be invested by the Fund. Typically, at least 20% of the Article 9 CIS which have passed the quantitative screening assessments would be screened out based on the ESG score.

Sources and processing of ESG data

The ESG data sources and processes used for reporting are currently under development and details will be available soon.

AXA IM Select Voting Policy and Engagement Policy

At AXA IM Select Asia Limited, we are committed to acting as a responsible investor on your behalf. A summary of the AXA IM Select Voting Policy is available upon request. The Voting Policy has been produced on the basis of describing AXA IM Select's approach to meeting best practice standards for the funds we manage directly and for the funds that we delegate to others to manage on our behalf.

Under S.I. No. 81 of 2020 the European Union (Shareholders’ Rights) Regulation which came into force on 30 March 2020, asset managers such as AXA IM Select are required either to publish an Engagement Policy and information concerning about how we comply with the regulations, or to explain why not.

The engagement policy must describe how the firm:

a) integrates shareholder engagement in its investment strategy,

b) monitors investee companies on relevant matters, including strategy, financial and nonfinancial performance and risk, capital structure, social and environmental impact and corporate governance,

c) conducts dialogues with investee companies,

d) exercises voting rights and other rights attached to shares,

e) cooperates with other shareholders,

f) communicates with relevant stakeholders of the investee companies, and

g) manages actual and potential conflicts of interest in relation to its engagement.

AXA IM Select has decided not to publish an Engagement Policy at this time.

As a ‘multi manager’ firm, apart from investment funds constituted as corporations, AXA IM Select does not invest directly in company shares. In the absence of clear regulatory guidance or clear market practice on how the engagement policy should apply to multi-managers, we have decided to continue to rely on our existing Voting Policy which works towards the same ends, but is based on guidance (such as individual guidance from the UK Financial Reporting Council) on how multi-managers should promote stewardship and engagement.

We will keep this decision under review and may publish an Engagement Policy at a later date if required by regulations or if such policy will add value to our clients.

Risk Management

To monitor the ESG profiles of Funds directly managed by the Manager, rules are in place to check the SFDR classification of the underlying instruments to ensure the ESG focus of the Fund is followed.

On a quarterly basis, a screening of the ESG scoring will be performed to assess the sustainability of the investments.